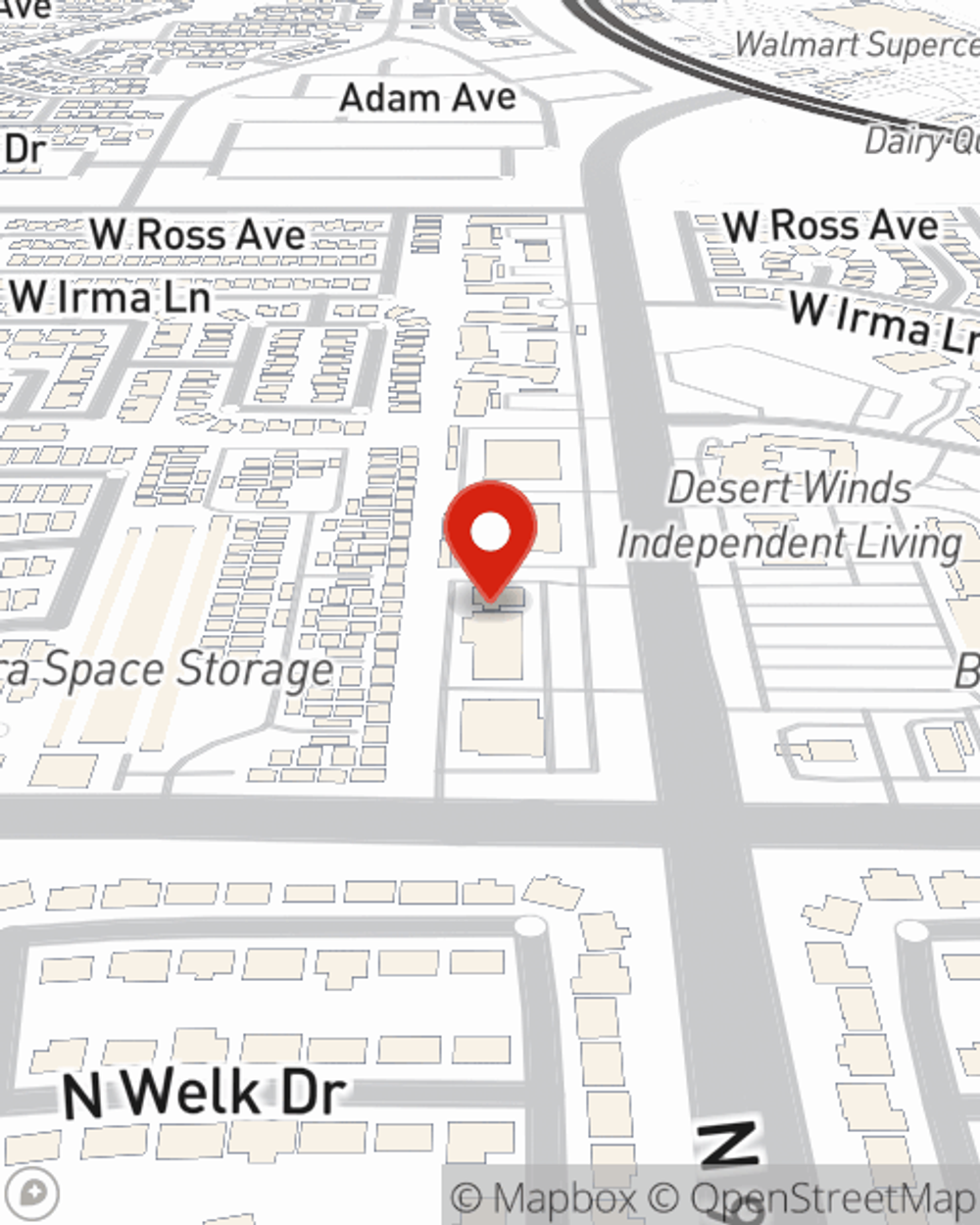

Business Insurance in and around Peoria

One of Peoria’s top choices for small business insurance.

Cover all the bases for your small business

Insure The Business You've Built.

Running a small business is no joke. Getting the right insurance should be the least of your worries. State Farm insures small businesses that fall under the umbrella of retailers, contractors, specialized professions and more!

One of Peoria’s top choices for small business insurance.

Cover all the bases for your small business

Small Business Insurance You Can Count On

The passion you have to be a leader in your field is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Justin Gemoll. With an agent like Justin Gemoll, your coverage can include great options, such as commercial auto, business owners policies and worker’s compensation.

The right coverages can help keep your business safe. Consider calling or emailing State Farm agent Justin Gemoll's office today to learn about your options and get started!

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Justin Gemoll

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.